UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a party other than the Registrant ¨

| Filed by the Registrant ☒ Filed by a party other than the Registrant ☐ |

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to §240.14a-12 | |

The TJX Companies, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| No fee required | ||||||||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||||||

| 1) | Title of each class of securities to which transaction applies:

| |||||||

| 2) | Aggregate number of securities to which transaction applies:

| |||||||

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||||||

| 4) | Proposed maximum aggregate value of transaction:

| |||||||

| 5) | Total fee paid:

| |||||||

| Fee paid previously with preliminary materials. | ||||||||

| Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | ||||||||

| 1) | Amount Previously Paid:

| |||||||

| 2) | Form, Schedule or Registration Statement No.:

| |||||||

| 3) | Filing Party:

| |||||||

| 4) | Date Filed:

| |||||||

|

770 Cochituate Road

Framingham, Massachusetts 01701

April 24, 201526, 2018

Dear Fellow Stockholder:Shareholder:

We cordially invite you to attend our 20152018 Annual Meeting on Thursday,Tuesday, June 11, 2015,5, 2018, at 9:00 a.m. (local time), to be held at our offices, 770 Cochituate Road, Framingham, Massachusetts. Please enter through the Northeast Entrance.Hilton Garden Inn Montreal Centre-Ville, 380 Sherbrooke St. West, Montreal, Quebec, H3A 0B1, Canada.

The proxy statement accompanying this letter describes the business we will consider at the meeting. Please read the proxy statement and vote your shares. Your vote is important regardless of the number of shares you own. Please read the proxy statement and vote your shares. Instructions for Internetonline and telephone voting are attached to your proxy card. If you prefer, you can vote by mail by completing and signing your proxy card and returning it in the enclosedpre-paid return envelope.

We hope that you will be able to join us on June 11th.5th. Thank you for your support of TJX.

Sincerely,

|  | |||

| Carol Meyrowitz | ||||

Executive Chairman of the Board |

Ernie Herrman Chief Executive Officer and President | |||

Printed on Recycled Paper

| ||||

The TJX Companies, Inc.

NOTICE OF

ANNUAL MEETING OF STOCKHOLDERSSHAREHOLDERS

June 11, 2015

5, 2018

The 2018 Annual Meeting of StockholdersShareholders of The TJX Companies, Inc. will be held at our offices, 770 Cochituate Road, Framingham, Massachusettsthe Hilton Garden Inn Montreal Centre-Ville, 380 Sherbrooke St. West, Montreal, Quebec, H3A 0B1, Canada, on Thursday,Tuesday, June 11, 2015,5, 2018, at 9:00 a.m. (local time) to vote on:

StockholdersShareholders of record at the close of business on April 14, 20159, 2018 are entitled to notice of, and entitled to vote at, the Annual Meeting and any adjournments or postponements thereof.of that meeting.

To attend the Annual Meeting, you must demonstrateshow that you were a TJX stockholdershareholder at the close of business on April 14, 20159, 2018 or hold a valid proxy for the Annual Meeting from such a stockholder.shareholder. If you are not a stockholdershareholder of record but hold shares through a bank, broker, trustee or nominee,other third party, you will need to bring proof of your beneficial ownership as of April 14, 2015,9, 2018, such as a brokerage account statement showing your ownership on that date or similar evidence of ownership. All stockholdersshareholders will need to check in upon arrival and receive attendee badges for security purposes. Please allow additional time for these procedures.

By Order of the Board of Directors,

Ann McCauleyAlicia C. Kelly

Secretary

Framingham, Massachusetts

April 24, 201526, 2018

YOUR VOTE IS IMPORTANT.

PLEASE VOTE OVERONE OF THE INTERNET, BY TELEPHONE OR BY MAIL.FOLLOWING WAYS:

| BY MAIL | ONLINE | BY PHONE | IN PERSON | |||

Sign and Return Proxy Card Follow instructions provided in proxy materials | at: www.envisionreports.com/TJX Follow instructions provided in proxy materials | call: 1-800-652-VOTE (8683) Follow instructions provided in proxy materials | Attend Annual Meeting Complete and sign ballot to cast your vote at meeting |

| 1 | ||||

| 3 | ||||

| 3 | ||||

| 5 | ||||

| 8 | ||||

| 12 | ||||

| 12 | ||||

| 13 | ||||

| 13 | ||||

| 15 | ||||

| 19 | ||||

| 20 | ||||

| 21 | ||||

| 43 | ||||

| 43 | ||||

| 45 | ||||

| 47 | ||||

| 49 | ||||

| 49 | ||||

| 50 | ||||

| 53 | ||||

| 58 | ||||

| 59 | ||||

| 59 | ||||

| 60 | ||||

| 61 | ||||

| 61 | ||||

| 62 | ||||

PROPOSAL 5: SHAREHOLDER PROPOSAL—AMENDING TJX’S CLAWBACK POLICY | 64 | |||

PROPOSAL 6: SHAREHOLDER PROPOSAL— SUPPLY CHAIN POLICY ON PRISON LABOR | 66 | |||

| 68 | ||||

| 69 | ||||

2018 Proxy Statement i

FISCAL 2018 BUSINESS REVIEW

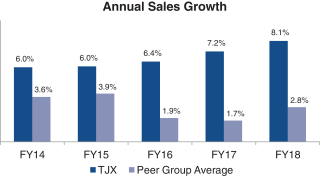

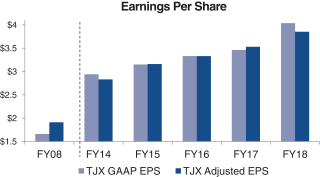

Financial Results/ Business Execution | Shareholder Value Creation | Business/Strategic Results | ||||||

• Over $35 billion net sales, an increase of 8% over fiscal 2017 • Comparable store sales1 increased 2% over a strong 5% in fiscal 2017 • Surpassed $5 billion in net sales at HomeGoods, our U.S. home division | • 7.4% total shareholder return • Returned $2.4 billion to shareholders through our share repurchase and dividend programs • Increased dividend by 20% during fiscal 2018; announced plan to increase an additional 25% in fiscal 2019 • $49.3 billion market cap at fiscalyear-end | • Opened our 4,000th store, with 4,070 total stores at fiscal year-end • More than 250 stores opened during fiscal 2018 • Launched a second home store concept in the U.S., Homesense |

| 1 | Comparable store sales are defined in Appendix A. |

During fiscal 2018, The TJX Companies, Inc. (TJX, the company, or we) solidly executed our business plan and growth strategies, increasing comparable store sales, driven by customer traffic, and growing our store base globally while maintaining focus on driving profitable sales, reinvesting in the business, managing expenses, and returning value to shareholders. At the beginning of fiscal 2019, we announced plans to continue our growth and reinvestment initiatives, including driving comparable store sales and customer traffic gains, increasing our long-term store growth potential for some of our chains, and, in light of U.S. tax law changes, planning a more substantial share buyback program and increase in our quarterly dividends and additional investments in our Associates and our communities. Fiscal 2018 was a 53-week year; fiscal 2017 was a 52-week year.

FISCAL 2018 SHAREHOLDER OUTREACH AND GOVERNANCE HIGHLIGHTS

Compensation Program Outreach. During fiscal 2018, in response to our most recentsay-on-pay vote, the Executive Compensation Committee of our Board led an extensive outreach initiative focused on our executive compensation program to better understand the concerns and perspectives of our broad shareholder base. The resulting changes we made to our fiscal 2019 executive compensation program are presented in our Compensation Discussion & Analysis section (CD&A) along with the discussion of our fiscal 2018 program and results.

Governance Update: Proxy Access. In February 2018, we amended our by-laws to implement proxy access to provide that one or more shareholders (up to 20, collectively), owning at least 3% of TJX’s outstanding common stock continuously for at least three years, may nominate for election to the Board and include in TJX’s proxy materials up to the greater of two individuals or 20% of the Board, subject to the provisions in our by-laws. We also continued to discuss and engage on issues of interest to our shareholders throughout the year.

2018 Proxy Statement 1

VOTING ITEMS FOR 2018 ANNUAL MEETING OF STOCKHOLDERSSHAREHOLDERS

June 11, 2015

PROXY STATEMENT

Why am I receiving this proxy statement?The Board of Directors of The TJX Companies, Inc., (TJX or the company) is sending this proxy statement to you as a shareholder of TJX, is solicitingto solicit your proxy for the 20152018 Annual Meeting to be held on June 11, 2015,5, 2018 to vote on the following items:

Who can vote at the meeting?Stockholders of record

HOW TO VOTE YOUR SHARES

If you owned TJX common stock at the close of business on April 14, 20159, 2018, the record date for our 2018 Annual Meeting, you are entitled to vote at the meeting. Each of the 682,260,150626,927,947 shares of common stock outstanding on the record date is entitled to one vote.

How do I vote?There are multiple ways to vote your shares.

Please note that the process for Internet and telephone voting is intended to authenticate your identity and permit you to confirm that your voting instructions are accurately reflected. Please seeVoting Requirements and Proxies on page 49 for further information about voting.

Can Imail. You can change or revoke my proxy?Yes. If you are a stockholder of record, you may revoke your proxy at any time before it is voted at the Annual Meetingmeeting by voting later online or by Internet or telephone, returning a later-dated proxy card by mail, or delivering a written revocation to the Secretary of TJX at our corporate offices at 770 Cochituate Road, Framingham, Massachusetts 01701.

With proper documentation, you may also vote in person at the meeting is requiredmeeting. Please see Voting Requirements and Practices on p. 69 for a quorum for the meeting.more information.

This proxy statement, the proxy card, and the Annual Report to StockholdersShareholders for our fiscal year ended January 31, 2015February 3, 2018 (fiscal 2015)2018) are being first mailed to stockholdersshareholders on or about the date of the notice of meeting, April 24, 2015.26, 2018.

OTHER INFORMATION

Please note below other topics included in this proxy statement that may be of interest. This list does not cover all information included in this proxy statement that you should consider. You should review the entire proxy statement carefully before voting your shares.

• Board Responsibilities (see p. 3) | • Compensation Discussion and Analysis (see p. 21) | |

• Board Service at TJX (see p. 5) | • Corporate Responsibility (see p. 12) | |

• Board Committees and Meetings (see p. 8) | • Communicating with Our Board (see p. 12) | |

• Nominees and Their Qualifications (see p. 15) | • Voting Requirements and Practices (see p. 69) | |

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING TO BE HELD ON JUNE 11, 2015:5, 2018: THIS PROXY STATEMENT AND ANNUAL REPORT ANDFORM 10-K FOR FISCAL 20152018 ARE AVAILABLE AT HTTP://WWW.ENVISIONREPORTS.COM/TJX

2 The TJX Companies, Inc.

Integrity has always been a core tenet of TJX. We seek to perform with the highest standards of ethical conduct and in compliance with all laws and regulations that relate to our businesses. Our core Board practices and policies are reflected in our Corporate Governance Principles and Director Code of Business Conduct and Ethics. Our Board also maintains written charters for each of our Board committees, discussed further below.

Our Board of Directors is responsible for overseeing the business and affairs of the company, and, as part of this responsibility, for regularly monitoring the effectiveness of management’s implementation of strategy, policies, and decisions. The Board, with management, also believes that the interests of our shareholders are enhanced by responsibly considering the interests of our customers, Associates, suppliers, service providers, and communities where we operate.

During the year, our Board reviews with management our strategies, including our plans to drive profitable sales and increase market share, while reinvesting in the business and managing expenses. The Board also oversees management succession planning and has oversight responsibility for our enterprise risk management, discussed below. In addition, as discussed further below, the Board considers Board succession planning and composition.

RISK OVERSIGHT

It is management’s responsibility to manage risk and bring to the Board’s attention risks that are material to TJX. The Board has oversight responsibility for the systems established to report and monitor the most significant risks applicable to TJX. The Board administers its risk oversight role directly and through its committee structure and the committees’ regular communications with the full Board. The committees escalate risks to the full Board as they determine to be appropriate. In general terms:

2018 Proxy Statement 3

LEADERSHIP STRUCTURE

Our Board has separated the role of CEO and Chairman. Carol Meyrowitz has served as Chairman of the Board since June 2016 and as Executive Chairman since the beginning of fiscal 2017 when Ernie Herrman succeeded her as Chief Executive Officer. Ms. Meyrowitz has wide-ranging,in-depth knowledge of our business arising from her many years of service to TJX. As Executive Chairman, she has provided, and is expected to continue to provide, effective leadership to the Board as well as support for management as an active and integral member of the executive team.

As provided in our Corporate Governance Principles, because our current Chairman is not independent, our independent directors have elected an independent Lead Director, John F. O’Brien, to serve as a liaison between the independent directors, the Executive Chairman, and management. As Lead Director, Mr. O’Brien provides independence in TJX’s Board leadership through his review and approval of Board meeting agendas, his participation in management business review meetings, and his leadership of the independent directors. His role is described further below.

The Board believes that the separate roles of Chairman, Chief Executive Officer, and Lead Director are in the best interests of TJX and its shareholders.

| Independent Lead Director Role |

• Meet at least quarterly with our Chief Executive Officer and Executive Chairman, and with other senior officers as necessary; |

• Generally attend regular management business review meetings; |

• Schedule meetings of the independent directors; |

• Preside at meetings of the Board in absence of the Executive Chairman, including meetings of the independent directors; |

• Approve Board meeting schedules and agendas; |

• Attend the meetings of each Board committee; and |

• Undertake other responsibilities designated by the independent directors, or as otherwise considered appropriate. |

4 The TJX Companies, Inc.

Board Independence

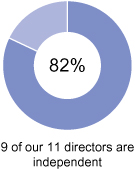

As provided in our Corporate Governance Principles, at leasttwo-thirds of the members of our Board should be independent directors. An independent director is one who the Board has affirmatively determined has no material relationship with TJX (either directly or as a partner, shareholder, or officer of an organization that has a relationship with the company). To assist it in making its independence determination, the Board has adopted categorical independence standards in our Corporate Governance Principles that are based on the independence standards required by the New York Stock Exchange (NYSE) for its listed companies. As part of the Board’s annual review of director independence, the Board considers the Corporate Governance Committee’s independence assessment and recommendation and reviews any transactions and relationships between each director or any member of his or her immediate family and TJX, in accordance with our Corporate Governance Principles (see Transactions with Related Persons, p. 13). To the extent there were any such relationships or transactions, the Board considers whether they are inconsistent with a determination that the director is independent.

As a result of this review, our Board unanimously determined that 9 directors of our current11-member Board are independent: Zein Abdalla, José B. Alvarez, Alan M. Bennett, David T. Ching, Michael F. Hines, Amy B. Lane, Jackwyn L. Nemerov, John F. O’Brien, and Willow B. Shire. None of these directors had any relationship with TJX that implicated our categorical standards of independence. Carol Meyrowitz, as Executive Chairman, and Ernie Herrman, as Chief Executive Officer and President, are executive officers of TJX and are therefore not independent.

Board Diversity

As a global company with approximately 249,000 Associates at our fiscal year-end, we consider diversity among our Associates, customers, vendors, and other business associates to be part of who we are and core to our culture. At the Board level and throughout our organization, we strive to promote the benefits of leveraging differences, fostering inclusion, and promoting a talented and diverse workforce. We seek to have a Board that represents diversity as to experience, gender, and ethnicity/race and that reflects a range of talents, ages, skills, viewpoints, professional experiences, and educational backgrounds to provide sound, expert, and prudent guidance on our operations, strategy, and interests.

The Corporate Governance Committee does not have a formal diversity policy that is applied when evaluating the suitability of individual Board nominees, but takes diversity, including geographic, gender, age, ethnic, and racial diversity, into account among the many factors it considers. Each individual is evaluated in the context of the Board as a whole, with the objective of recommending a group that the Committee believes can best continue the success of our business and represent shareholder interests through the exercise of sound judgment using its collective

2018 Proxy Statement 5

diversity of experience. The Committee considers whether candidates have a general understanding of disciplines relevant to the success of a large, global, and complex publicly traded company in today’s business environment; understanding of our business and industry; professional background and leadership experience; experience on the boards of other large publicly traded companies; and personal accomplishments.

We value the many kinds of diversity reflected in our Board and nominees.

Board Composition

|

|

|

Board Assessment

The Board believes it is important to have highly engaged directors and that the Board’s composition be aligned with the changing needs of the company for current and future business environments. We have a regular, comprehensive review process for evaluating the performance and composition of our Board. Our Corporate Governance Committee oversees the annual performance evaluation of the Board as a whole, our Chairman, our independent Lead Director, and each of our individual directors.

Currently, our process, which we review annually through the Corporate Governance Committee, includes both self-assessments and peer review of individual directors and of the Board overall, including an assessment of skills and overall effectiveness, and a consideration of the current and future needs of the Board. In addition, each of our independent committees conducts an annual self-assessment of the committee and the chair, with a process overseen by the Corporate Governance Committee.

Director Qualifications and Nominations

The Corporate Governance Committee recommends to the Board individuals to be director nominees who, in the opinion of the Committee, have high personal and professional ethics, integrity, and values; have demonstrated ability and judgment; and will be committed to collectively serving the long-term best interests of our shareholders. The Corporate Governance Committee considers a range of factors when considering individual candidates. These factors include professional experience, particularly in light of our business and current needs for the Board, independence, and geographic, gender, age, ethnic, and racial diversity (discussed above). The Committee seeks nominees who have established strong professional reputations with experience in substantive areas that are important to our business, such as:

• international operations and growth; • marketing and brand management; • sales, buying, and distribution; • accounting, finance, and capital structure; • succession planning; | • strategic planning and leadership of complex • human resources and talent development • risk oversight; • strategy, growth, and innovation. |

6 The TJX Companies, Inc.

Finding Candidates. The Corporate Governance Committee’s process for identifying and evaluating candidates, including candidates recommended by shareholders, includes actively seeking to identify qualified individuals by various means that may include reviewing lists of possible candidates, such as chief executive officers of public companies or leaders of finance or other industries; considering recommendations from a range of sources, such as the Board of Directors, management or other Associates, shareholders, and industry contacts; and engaging a third-party search firm to expand our search and assist in compiling information about possible candidates.

The Corporate Governance Committee has a policy for shareholder recommendations of candidates for director nominees, which is available on our website. Any shareholder may submit, in writing, one candidate for consideration for each shareholder meeting at which directors are to be elected. Shareholders wishing to recommend a candidate must submit the recommendation by a date not later than the 120th calendar day before the first anniversary of the date that we released our proxy statement to shareholders in connection with the previous year’s annual meeting. Recommendations should be sent to the Secretary of TJX:

Office of the Secretary/ Legal Department

The TJX Companies, Inc.

770 Cochituate Road

Framingham, Massachusetts 01701

As described in the policy, a recommendation must provide specified information about, certifications from, and consents and agreements of, the candidate. The Corporate Governance Committee evaluates candidates for the position of director recommended by shareholders in the same manner as candidates from other sources. The Corporate Governance Committee will determine whether to interview any candidates and may seek additional information about candidates from third-party sources.

Majority Voting

Ourby-laws provide for the election of directors in an uncontested election by a majority of the shares properly cast at the meeting. Our Corporate Governance Principles require any incumbent nominee for director to provide an irrevocable contingent resignation to the Secretary of TJX at least 14 days in advance of the distribution date for proxy solicitation materials for the shareholder meeting at which such director is expected to be nominated to stand for election. This resignation would be effective only if (a) the director fails to receive the requisite majority vote in an uncontested election and (b) the Board accepts the resignation. Our Corporate Governance Principles provide procedures for the consideration of this kind of resignation by the Board. Within 90 days of the date of the annual meeting of shareholders, the Board, with the recommendation of the Corporate Governance Committee, will act upon such resignation. In making its decision, the Board will consider the best interests of TJX and its shareholders and will take what it deems to be appropriate action, which may include accepting or rejecting the resignation or taking further measures to address those concerns that were the basis for the underlying shareholder vote.

Board Service Policies

Under our Corporate Governance Principles, directors who are CEOs of public companies should not serve on more than two boards of public companies besides their own, and no director should serve on more than five boards of public companies, including the TJX Board. Under our Audit Committee Charter, members of the Audit Committee should not serve on the audit committee of more than two other public companies. When a director’s principal occupation or business association changes during his or her tenure as a director, our Corporate Governance Principles provide that the director is required to tender his or her resignation from the Board, and the Corporate Governance Committee will recommend to the Board any action to be taken with respect to the resignation.

Stock Ownership Guidelines for Directors. Our Corporate Governance Principles provide that anon-employee director is expected to attain stock ownership with a fair market value equal to at least five times the annual retainer paid to the director within five years of initial election to the Board. New board members are also expected to acquire at least $10,000 of our common stock outright upon joining the Board. As described further in the CD&A, our executive officers are also subject to stock ownership guidelines. As of April 9, 2018, all of our directors and executive officers were in compliance with our ownership guidelines.

2018 Proxy Statement 7

Board Attendance. During fiscal 2018, our Board met six times. The independent directors also met separately at regularly scheduled executive sessions. It is our policy, included in our Corporate Governance Principles, that all directors standing for reelection are expected to attend the annual meeting of shareholders. All directors who stood for reelection at the 2017 Annual Meeting were in attendance.

The Board of Directors has five standing committees: Audit, Corporate Governance, Executive Compensation, Finance, and an Executive Committee, each described in more detail below. All members of the Audit, Corporate Governance, Executive Compensation, and Finance Committees arenon-employee directors and meet the independence standards adopted by the Board in compliance with NYSE listing standards for that committee. The Executive Committee includes our Executive Chairman who is not independent. While each committee has specific, designated responsibilities, each committee may act on behalf of the entire Board to the extent designated by the respective charter or otherwise by the Board. The Corporate Governance Committee annually reviews and makes recommendations on the composition of our standing committees.

Our committees regularly invite other Board members to join their meetings and, as necessary, otherwise report on their activities to the entire Board. The table below provides information about membership and meetings of these committees during fiscal 2018:

Name

| Audit

| Corporate

Governance | Executive

Compensation | Finance

| Executive

| |||||

Zein Abdalla

| +

| +

| ||||||||

José B. Alvarez1

| +

| +

| ||||||||

Alan M. Bennett

| *

| +

| ||||||||

David T. Ching

| +

| +

| ||||||||

Ernie Herrman

| ||||||||||

Michael F. Hines

| *

| +

| ||||||||

Amy B. Lane

| +

| *

| +

| |||||||

Carol Meyrowitz

| *

| |||||||||

Jackwyn L. Nemerov

| +

| |||||||||

John F. O’Brien

| +

| |||||||||

Willow B. Shire

| *

| +

| ||||||||

Number of meetings during fiscal 2018

| 12

| 4

| 8

| 4

| —

| |||||

| * | Committee Chairman |

| 1 | Mr. Alvarez is not standing for election at the 2018 Annual Meeting. |

Each director attended at least 75% of all meetings of the Board and committees of which he or she was then a member.

AUDIT COMMITTEE

Mr. Hines, Chairman; Mr. Alvarez; Mr. Ching; Ms. Lane

The Audit Committee is directly responsible for the appointment, compensation, retention, and oversight of the independent registered public accounting firm retained to audit the company’s financial statements and oversight of the financial reporting process. The Audit Committee’s responsibilities include, among other things:

8 The TJX Companies, Inc.

As part of these responsibilities, in addition to assuring the regular rotation of the lead partner of the independent auditor, as required by law, the Audit Committee, including its Chairman, is involved in the selection of, and reviews and evaluates the performance of, the independent auditor, including the lead audit partner, and further considers whether there should be regular rotation of the audit function among firms. Please see the Audit Committee charter, available on our website, tjx.com, for further details.

CORPORATE GOVERNANCE COMMITTEE

Ms. Shire, Chairman; Mr. Abdalla; Mr. Ching

The Corporate Governance Committee’s responsibilities include, among other things:

Please see the Corporate Governance Committee charter, available on our website, tjx.com, for further details.

EXECUTIVE COMPENSATION COMMITTEE

Mr. Bennett, Chairman; Mr. Alvarez; Ms. Nemerov; Ms. Shire

The ECC’s responsibilities include, among other things:

2018 Proxy Statement 9

Pursuant to its charter, the ECC may delegate its authority to a subcommittee or to such other person that the ECC determines is appropriate and is permitted by applicable law, regulations, and listing standards.

The ECC also reviews our compensation policies and practices for our Associates to determine whether they give rise to risks that are reasonably likely to have a material adverse effect on the company. See Compensation Program Risk Assessment, below.

Please see the ECC charter, available on our website, tjx.com, for further details.

FINANCE COMMITTEE

Ms. Lane, Chairman; Mr. Abdalla; Mr. Bennett; Mr. Hines

The Finance Committee is responsible for reviewing and making recommendations to the Board relating to our financial activities and condition. The Finance Committee’s responsibilities include, among other things:

Please see the Finance Committee charter, available on our website, tjx.com, for further details.

EXECUTIVE COMMITTEE

Ms. Meyrowitz, Chairman; Ms. Lane; Mr. O’Brien

The Executive Committee meets at such times as it determines to be appropriate and has the authority to act for the Board on specified matters during the intervals between meetings of the Board.

10 The TJX Companies, Inc.

COMPENSATION PROGRAM RISK ASSESSMENT

As part of our regular enterprise risk assessment process overseen by the Board and described above, we review the risks associated with our compensation plans and arrangements. In fiscal 2018, the ECC reviewed TJX’s Associate compensation policies and practices and determined that they do not give rise to risks that are reasonably likely to have a material adverse effect on TJX. The ECC’s assessment considered what risks could be created or encouraged by our executive and broad-based compensation plans and arrangements worldwide; how those potential risks are monitored, mitigated, and managed; and whether those potential risks are reasonably likely to have a material adverse effect on TJX.

The assessment was led by our Chief Risk and Compliance Officer, whose responsibilities include leadership of our enterprise risk management process, and included consultation with and input from, among others, executive officers, senior human resources and financial executives, the ECC’s independent compensation consultant, and internal and external legal counsel. The assessment considered, among other things, factors intended to mitigate risk at TJX, including:

• Board and committee oversight; • the ECC’s use of an independent compensation consultant; • compensation mix, caps on payouts, and emphasis on objective performance-based pay; | • market checks; • Associate communications and training; and • company policies, internal controls, and risk management initiatives. |

The assessment also considered the balance of potential risks and rewards related to our compensation programs and the role of those programs in implementing our corporate strategy.

CODES OF CONDUCT AND ETHICS AND OTHER POLICIES

Global Code of Conduct for Associates. We have a Global Code of Conduct for our Associates that sets out our expectations that Associates conduct business with honesty and integrity and treat others with dignity and respect. Our Global Code of Conduct prohibits harassment, discrimination, and retaliation and addresses professional conduct, including employment policies, ethical business dealings, conflicts of interest, confidentiality, intellectual property rights, and the protection of confidential information, as well as adherence to laws and regulations applicable to the conduct of our business. We have a Code of Conduct helpline to allow Associates to voice their concerns. We also have procedures for Associates to report complaints regarding accounting and auditing matters, which are available on our website, tjx.com.

Code of Ethics for TJX Executives and Director Code of Business Conduct and Ethics. As noted above, we have a Director Code of Business Conduct and Ethics that is designed to promote honest and ethical conduct; compliance with applicable laws, rules, and regulations; and the avoidance of conflicts of interest for our Board members. We also have a Code of Ethics for TJX Executives governing our Executive Chairman, Chief Executive Officer and President, Chief Financial Officer, and other senior operating, financial, and legal executives. The Code of Ethics for TJX Executives is designed to ensure integrity in our financial reports and public disclosures. We intend to disclose any future amendments to, or waivers from, the Code of Ethics for TJX Executives and the Director Code of Business Conduct and Ethics, as required, within four business days of the waiver or amendment through a posting on our website or by filing a Current Report on Form8-K with the Securities and Exchange Commission, or SEC.

ONLINE AVAILABILITY OF INFORMATION

Our Corporate Governance Principles, Global Code of Conduct, Code of Ethics for TJX Executives, Director Code of Business Conduct and Ethics, and charters for our Audit, Corporate Governance, Executive, Executive Compensation, and Finance Committees are available on our website, tjx.com, in the Investors section under Governance: Governance Documents. Information appearing on tjx.com is not a part of, and is not incorporated by reference in, this proxy statement.

2018 Proxy Statement 11

For more than 40 years, TJX has been focused on delivering great value to our customers through the combination of brand, fashion, price, and quality. At the same time, we are committed to our corporate responsibility mission of bringing value to our many important stakeholders—our Associates, customers, communities, vendors, and shareholders.

With our long-held principles of respect, honesty, and integrity, central to our efforts, our Corporate Responsibility program has evolved over time and has reflected our ‘smart for business, good for the world’ thinking. We categorize our global corporate responsibility efforts under four strategic pillars:

We remain focused on continuously enhancing our programs and making a positive, sustainable impact on the world in which we live and conduct our business. To learn more about our evolving efforts, please visit the Responsibility section of our website at tjx.com/responsibility.

We are interested in hearing from our shareholders and communicate regularly with shareholders throughout the year. Security holders and other interested parties may communicate directly with our Board, thenon-management directors or the independent directors as a group, the Lead Director, or any other specified individual director or directors.

To contact us, address your correspondence to the individual or group you would like to reach and send it to us, c/o Office of the Secretary/Legal Department:

The TJX Companies, Inc.

770 Cochituate Road

Framingham, Massachusetts 01701

The Secretary will forward these communications to the relevant group or individual. Shareholders and others can communicate complaints regarding accounting, internal accounting controls, or auditing matters by writing to the

12 The TJX Companies, Inc.

Audit Committee, c/o Corporate Internal Audit Director, The TJX Companies, Inc., 770 Cochituate Road, Framingham, Massachusetts 01701.

TRANSACTIONS WITH RELATED PERSONS

Under its charter, the Corporate Governance Committee is responsible for reviewing and approving or ratifying any transaction in which, in addition to TJX, any of our directors, director nominees, executive officers (or their immediate family members), or any greater than 5% shareholders (or their immediate family members) is a participant and has a direct or indirect material interest, as provided under SEC rules. In the course of reviewing potential related person transactions, the Corporate Governance Committee considers the nature of the related person’s interest in the transaction; the presence of standard prices, rates, or charges or terms otherwise consistent with arms-length dealings with unrelated third parties; the materiality of the transaction to each party; the reasons for TJX entering into the transaction with the related person; the potential effect of the transaction on the status of a director as an independent, outside, or disinterested director or committee member; and any other factors the Corporate Governance Committee may deem relevant. Our General Counsel’s office is primarily responsible for the implementation of processes and procedures for screening potential transactions and providing information to the Corporate Governance Committee. During fiscal 2018, asister-in-law of Mr. Sherr and a daughter of Ms. Meyrowitz were employed by TJX. They received compensation from us for fiscal 2018 and the beginning of fiscal 2019 totaling approximately $281,720 and $133,920, respectively, consistent with other Associates at their levels and responsibilities. They also participated in company benefit plans generally available to similarly situated Associates. As described below in Beneficial Ownership, The Vanguard Group, Inc. reported that it was the beneficial owner of more than 5% of TJX’s outstanding common stock. TJX expects to pay The Vanguard Group, Inc. and its affiliates approximately $1,885,420 for services primarily provided during fiscal 2018 and the first quarter of fiscal 2019 in connection with TJX’s retirement savings plans (including recordkeeping, trustee, and related services). Our Corporate Governance Committee discussed and approved or ratified these transactions, consistent with our review process described above.

The Audit Committee operates in accordance with a written charter adopted by the Board and reviewed annually by the Committee. We are responsible for overseeing the quality and integrity of TJX’s accounting, auditing and financial reporting practices. The Audit Committee is composed solely of members who are independent, as defined by the NYSE and TJX’s Corporate Governance Principles. Further, the Board has determined that two of our members (Mr. Hines and Ms. Lane) are audit committee financial experts as defined by the rules of the SEC.

We met 12 times during fiscal 2018, including 4 meetings held with TJX’s Chief Financial Officer, Corporate Controller, Corporate Internal Audit and PricewaterhouseCoopers LLP, or PwC, TJX’s independent registered public accounting firm, prior to the public release of TJX’s quarterly and annual earnings announcements in order to discuss the financial information contained in the announcements. Management has the responsibility for the preparation of TJX’s financial statements, and PwC has the responsibility for the audit of those statements.

We took numerous actions to discharge our oversight responsibility with respect to the audit process. We reviewed and discussed the audited financial statements of TJX as of and for fiscal 2018 with management and PwC. We received the written disclosures and the letter from PwC required by applicable requirements of the Public Company Accounting Oversight Board (PCAOB) regarding the independent accountant’s communications with the audit committee concerning independence and the potential effects of any disclosed relationships on PwC’s independence and discussed with PwC its independence. We discussed with management, the internal auditors, and PwC TJX’s internal control over financial reporting and management’s assessment of the effectiveness of internal control over financial reporting and the internal audit function’s organization, responsibilities, budget, and staffing. We reviewed with both PwC and our internal auditors their audit plans, audit scope and audit results.

We reviewed and discussed with PwC communications required by the Standards of the PCAOB (United States), as described in PCAOB Auditing Standard 1301, “Communication with Audit Committees,” and, with and without

2018 Proxy Statement 13

management present, discussed and reviewed the results of PwC’s examination of TJX’s financial statements. We also discussed the results of the internal audit examinations with and without management present.

Based on these reviews and discussions with management and PwC, we recommended to the Board that TJX’s audited financial statements be included in its Annual Report on Form10-K for fiscal 2018 for filing with the SEC. We also have selected PwC as the independent registered public accounting firm for fiscal 2019, subject to ratification by TJX’s shareholders.

Audit Committee

Michael F. Hines,Chairman

José B. Alvarez

David T. Ching

Amy B. Lane

AUDITOR FEES

The aggregate fees that TJX was billed for professional services rendered by PwC for fiscal 2018 and fiscal 2017 were:

(In thousands)

| 2018

| 2017

| ||||||

Audit

| $

| 8,730

|

| $

| 8,262

|

| ||

Audit Related

|

| 476

|

|

| 790

|

| ||

Tax

|

| 871

|

|

| 840

|

| ||

All Other

|

| 66

|

|

| 55

|

| ||

Total

| $

| 10,143

|

| $

| 9,947

|

| ||

The Audit Committee is responsible for the audit fee negotiations associated with the company’s retention of PwC. The Audit Committeepre-approves all audit services and all permittednon-audit services by PwC, including engagement fees and terms. The Audit Committee has delegated the authority to take such action between meetings to the Audit Committee chairman, who reports the decisions made to the full Audit Committee at its next scheduled meeting.

Our policies prohibit TJX from engaging PwC to provide any services relating to bookkeeping or other services related to accounting records or financial statements, financial information system design and implementation, appraisal or valuation services, fairness opinions orcontribution-in-kind reports, actuarial services, internal audit outsourcing, any management function, legal services or expert services not related to audit, broker-dealer, investment adviser, or investment banking services, or human resource consulting. In addition, the Audit Committee evaluates whether TJX’s use of PwC for permittednon-audit services is compatible with maintaining PwC’s independence. The Audit Committee concluded that PwC’s provision ofnon-audit services, which were approved in advance, was compatible with their independence.

14 The TJX Companies, Inc.

PROPOSAL 1 -1: ELECTION OF DIRECTORS

NomineesBoard Independence

As provided in our Corporate Governance Principles, at leasttwo-thirds of the members of our Board should be independent directors. An independent director is one who the Board has affirmatively determined has no material relationship with TJX (either directly or as a partner, shareholder, or officer of an organization that has a relationship with the company). To assist it in making its independence determination, the Board has adopted categorical independence standards in our Corporate Governance Principles that are based on the independence standards required by the New York Stock Exchange (NYSE) for its listed companies. As part of the Board’s annual review of director independence, the Board considers the Corporate Governance Committee’s independence assessment and Their Qualificationsrecommendation and reviews any transactions and relationships between each director or any member of his or her immediate family and TJX, in accordance with our Corporate Governance Principles (see Transactions with Related Persons, p. 13). To the extent there were any such relationships or transactions, the Board considers whether they are inconsistent with a determination that the director is independent.

As a result of this review, our Board unanimously determined that 9 directors of our current11-member Board are independent: Zein Abdalla, José B. Alvarez, Alan M. Bennett, David T. Ching, Michael F. Hines, Amy B. Lane, Jackwyn L. Nemerov, John F. O’Brien, and Willow B. Shire. None of these directors had any relationship with TJX that implicated our categorical standards of independence. Carol Meyrowitz, as Executive Chairman, and Ernie Herrman, as Chief Executive Officer and President, are executive officers of TJX and are therefore not independent.

Board Diversity

As a global company with approximately 249,000 Associates at our fiscal year-end, we consider diversity among our Associates, customers, vendors, and other business associates to be part of who we are and core to our culture. At the Board level and throughout our organization, we strive to promote the benefits of leveraging differences, fostering inclusion, and promoting a talented and diverse workforce. We seek to have a Board that represents diversity as to experience, gender, and ethnicity/race and that reflects a range of talents, ages, skills, viewpoints, professional experiences, and educational backgrounds to provide sound, expert, and prudent guidance on our operations, strategy, and interests.

The Corporate Governance Committee does not have a formal diversity policy that is applied when evaluating the suitability of individual Board nominees, but takes diversity, including geographic, gender, age, ethnic, and racial diversity, into account among the many factors it considers. Each individual is evaluated in the context of the Board as a whole, with the objective of recommending a group that the Committee believes can best continue the success of our business and represent shareholder interests through the exercise of sound judgment using its collective

2018 Proxy Statement 5

diversity of experience. The Committee considers whether candidates have a general understanding of disciplines relevant to the success of a large, global, and complex publicly traded company in today’s business environment; understanding of our business and industry; professional background and leadership experience; experience on the boards of other large publicly traded companies; and personal accomplishments.

We seekvalue the many kinds of diversity reflected in our Board and nominees.

Board Composition

|

|

|

Board Assessment

The Board believes it is important to have highly engaged directors and that the Board’s composition be aligned with the changing needs of the company for current and future business environments. We have a regular, comprehensive review process for evaluating the performance and composition of our Board. Our Corporate Governance Committee oversees the annual performance evaluation of the Board as a whole, our Chairman, our independent Lead Director, and each of our individual directors.

Currently, our process, which we review annually through the Corporate Governance Committee, includes both self-assessments and peer review of individual directors and of the Board overall, including an assessment of skills and overall effectiveness, and a consideration of the current and future needs of the Board. In addition, each of our independent committees conducts an annual self-assessment of the committee and the chair, with a process overseen by the Corporate Governance Committee.

Director Qualifications and Nominations

The Corporate Governance Committee recommends to the Board individuals to be director nominees who, in the opinion of the Committee, have high personal and professional ethics, integrity, and values; have demonstrated ability and judgment; and will be committed to collectively serving the long-term best interests of our shareholders. The Corporate Governance Committee considers a range of factors when considering individual candidates. These factors include professional experience, particularly in light of our business and current needs for the Board, independence, and geographic, gender, age, ethnic, and racial diversity (discussed above). The Committee seeks nominees who have established strong professional reputations sophistication and experience in the retail and consumer industries. We also seek nominees with experience in substantive areas that are important to our business, such as:

• international operations and growth; • marketing and brand management; • sales, buying, and distribution; • accounting, finance, and capital structure; • succession planning; | • strategic planning and leadership of complex • human resources and talent development • risk oversight; • strategy, growth, and innovation. |

6 The TJX Companies, Inc.

Finding Candidates. The Corporate Governance Committee’s process for identifying and evaluating candidates, including candidates recommended by shareholders, includes actively seeking to identify qualified individuals by various means that may include reviewing lists of possible candidates, such as international operationschief executive officers of public companies or leaders of finance or other industries; considering recommendations from a range of sources, such as the Board of Directors, management or other Associates, shareholders, and growth; marketingindustry contacts; and brand management; sales, buyingengaging a third-party search firm to expand our search and distribution; accounting, financeassist in compiling information about possible candidates.

The Corporate Governance Committee has a policy for shareholder recommendations of candidates for director nominees, which is available on our website. Any shareholder may submit, in writing, one candidate for consideration for each shareholder meeting at which directors are to be elected. Shareholders wishing to recommend a candidate must submit the recommendation by a date not later than the 120th calendar day before the first anniversary of the date that we released our proxy statement to shareholders in connection with the previous year’s annual meeting. Recommendations should be sent to the Secretary of TJX:

Office of the Secretary/ Legal Department

The TJX Companies, Inc.

770 Cochituate Road

Framingham, Massachusetts 01701

As described in the policy, a recommendation must provide specified information about, certifications from, and capital structure; strategic planningconsents and leadershipagreements of, complex organizations; human resourcesthe candidate. The Corporate Governance Committee evaluates candidates for the position of director recommended by shareholders in the same manner as candidates from other sources. The Corporate Governance Committee will determine whether to interview any candidates and development practices;may seek additional information about candidates from third-party sources.

Majority Voting

Ourby-laws provide for the election of directors in an uncontested election by a majority of the shares properly cast at the meeting. Our Corporate Governance Principles require any incumbent nominee for director to provide an irrevocable contingent resignation to the Secretary of TJX at least 14 days in advance of the distribution date for proxy solicitation materials for the shareholder meeting at which such director is expected to be nominated to stand for election. This resignation would be effective only if (a) the director fails to receive the requisite majority vote in an uncontested election and strategy, growth(b) the Board accepts the resignation. Our Corporate Governance Principles provide procedures for the consideration of this kind of resignation by the Board. Within 90 days of the date of the annual meeting of shareholders, the Board, with the recommendation of the Corporate Governance Committee, will act upon such resignation. In making its decision, the Board will consider the best interests of TJX and innovation. Our nominees holdits shareholders and will take what it deems to be appropriate action, which may include accepting or have held senior executive positions in large, complex organizationsrejecting the resignation or in businesses relatedtaking further measures to substantive areas important toaddress those concerns that were the basis for the underlying shareholder vote.

Board Service Policies

Under our business, and in these positions have gained experience in core management skills and substantive areas relevant to our business. Our nominees also have experience working with or servingCorporate Governance Principles, directors who are CEOs of public companies should not serve on more than two boards of public companies besides their own, and no director should serve on more than five boards of public companies, including the TJX Board. Under our Audit Committee Charter, members of the Audit Committee should not serve on the audit committee of more than two other public companies. When a director’s principal occupation or business association changes during his or her tenure as a director, our Corporate Governance Principles provide that the director is required to tender his or her resignation from the Board, and the Corporate Governance Committee will recommend to the Board any action to be taken with respect to the resignation.

Stock Ownership Guidelines for Directors. Our Corporate Governance Principles provide that anon-employee director is expected to attain stock ownership with a fair market value equal to at least five times the annual retainer paid to the director within five years of initial election to the Board. New board members are also expected to acquire at least $10,000 of our common stock outright upon joining the Board. As described further in the CD&A, our executive officers are also subject to stock ownership guidelines. As of April 9, 2018, all of our directors and board committees of other public companies, and each ofexecutive officers were in compliance with our nominees has an understanding of corporate governance practices and trends. In addition, our nominees have prior service onownership guidelines.

2018 Proxy Statement 7

Board Attendance. During fiscal 2018, our Board which has provided them with exposure to bothmet six times. The independent directors also met separately at regularly scheduled executive sessions. It is our business and the industrypolicy, included in which we compete. We believeour Corporate Governance Principles, that all our nominees possessdirectors standing for reelection are expected to attend the professional and personal qualifications necessaryannual meeting of shareholders. All directors who stood for board service and have highlighted noteworthy attributes for each directorreelection at the 2017 Annual Meeting were in the individual biographies below.attendance.

The individuals listed below have been nominatedBoard of Directors has five standing committees: Audit, Corporate Governance, Executive Compensation, Finance, and are standing for election at this year’s Annual Meeting. If elected, they will hold office until our 2016 Annual Meetingan Executive Committee, each described in more detail below. All members of Stockholdersthe Audit, Corporate Governance, Executive Compensation, and until their successorsFinance Committees are duly electednon-employee directors and qualified. All of our nominees are current directors. Other than William H. Swanson, who was electedmeet the independence standards adopted by the Board in January 2015,compliance with NYSE listing standards for that committee. The Executive Committee includes our Executive Chairman who is not independent. While each committee has specific, designated responsibilities, each committee may act on behalf of the entire Board to the extent designated by the respective charter or otherwise by the Board. The Corporate Governance Committee annually reviews and makes recommendations on the composition of our standing committees.

Our committees regularly invite other Board members to join their meetings and, as necessary, otherwise report on their activities to the entire Board. The table below provides information about membership and meetings of these committees during fiscal 2018:

Name

| Audit

| Corporate

Governance | Executive

Compensation | Finance

| Executive

| |||||

Zein Abdalla

| +

| +

| ||||||||

José B. Alvarez1

| +

| +

| ||||||||

Alan M. Bennett

| *

| +

| ||||||||

David T. Ching

| +

| +

| ||||||||

Ernie Herrman

| ||||||||||

Michael F. Hines

| *

| +

| ||||||||

Amy B. Lane

| +

| *

| +

| |||||||

Carol Meyrowitz

| *

| |||||||||

Jackwyn L. Nemerov

| +

| |||||||||

John F. O’Brien

| +

| |||||||||

Willow B. Shire

| *

| +

| ||||||||

Number of meetings during fiscal 2018

| 12

| 4

| 8

| 4

| —

| |||||

| * | Committee Chairman |

| 1 | Mr. Alvarez is not standing for election at the 2018 Annual Meeting. |

Each director attended at least 75% of all were electedmeetings of the Board and committees of which he or she was then a member.

AUDIT COMMITTEE

Mr. Hines, Chairman; Mr. Alvarez; Mr. Ching; Ms. Lane

The Audit Committee is directly responsible for the appointment, compensation, retention, and oversight of the independent registered public accounting firm retained to audit the company’s financial statements and oversight of the financial reporting process. The Audit Committee’s responsibilities include, among other things:

8 The TJX Companies, Inc.

As part of these responsibilities, in addition to assuring the regular rotation of the lead partner of the independent auditor, as required by law, the Audit Committee, including its Chairman, is involved in the selection of, and reviews and evaluates the performance of, the independent auditor, including the lead audit partner, and further considers whether there should be regular rotation of the audit function among firms. Please see the Audit Committee charter, available on our website, tjx.com, for further details.

CORPORATE GOVERNANCE COMMITTEE

Ms. Shire, Chairman; Mr. Abdalla; Mr. Ching

The Corporate Governance Committee’s responsibilities include, among other things:

Your Board of Directors unanimously recommends that you vote FOR the election of each of the nominees as director.

Zein Abdalla, 56

Director since 2012

Mr. Abdalla was the President of PepsiCo, Inc., a leading global food, snackcommittee and beverage company, from September 2012 through his retirement in December 2014, prior to which he served as CEO of PepsiCo Europe, a division of PepsiCo, starting in November 2009 and as President, PepsiCo Europe Region starting in January 2006. Mr. Abdalla previously held a variety of senior positions at PepsiCo since he joined that company in 1995, including as General Manager of PepsiCo’s European Beverage Business, General Manager of Tropicana Europe and Franchise Vice Presidentits chair;

José B. Alvarez, 52

Director since 2007

Mr. Alvarez has been a member of the faculty of the Harvard Business School since 2009. From August 2008 through December 2008, Mr. Alvarez was the Global Executive Vice President for Business Development for Ahold, a global supermarket retail company. From 2001 to August 2008, he held various executive positions with Stop & Shop/ Giant-Landover, Ahold’s U.S. subsidiary, including President and Chief Executive Officer of Stop & Shop/Giant-Landover from 2006 to 2008 and Executive Vice President, Supply Chain and Logistics from 2004 to 2006. Previously, he served in executive positions at Shaw’s Supermarkets, Inc. and began his career at the Jewel Food Stores subsidiary of American Stores Company in 1990. Mr. Alvarez is also a director of United Rentals, Inc. and served on the board of Church & Dwight Co., Inc. from 2011 until 2013. Mr. Alvarez’s long career in retail has given him broad experience in large retail chain management, including store management, supply chain, logistics, distribution and strategy.

Alan M. Bennett, 64

Director since 2007

Mr. Bennett served as the Chief Executive Officer and annually evaluating the performance of H&R Block Inc., a tax services provider, from July 2010 to May 2011 and was previously Interimthe Chief Executive Officer from November 2007 through August 2008. He was Senior Vice Presidentagainst such objectives; and Chief Financial Officer

Please see the Corporate Governance Committee charter, available on our website, tjx.com, for further details.

EXECUTIVE COMPENSATION COMMITTEE

Mr. Bennett, Chairman; Mr. Alvarez; Ms. Nemerov; Ms. Shire

The ECC’s responsibilities include, among other things:

David T. Ching, 62

Director since 2007

Mr. Ching was Senior Vice President and Chief Information Officer for Safeway Inc., a food and drug retailer, from 1994 to January 2013 and has consulted through DTC Associates LLC, focusing on management consulting and technology services, since 2013. Previously, Mr. Ching was the General Manager for British American Consulting Group, a software and consulting firm focusing on the distribution and retail industry. He also worked for Lucky Stores Inc., a subsidiary of American Stores Company from 1979 to 1993, including serving as the Senior Vice President of Information Systems. Mr. Ching’s strong technological experience and related management positions in the retail industry provide Mr. Ching expertise including information systems, information security and controls, technology implementation and operation, reporting and distribution in the retail industry.

Michael F. Hines, 59

Director since 2007

Mr. Hines served as Executive Vice President and Chief Financial Officer of Dick’s Sporting Goods, Inc., a sporting goods retailer, from 1995 to March 2007. From 1990 to 1995, he held management positions with Staples, Inc., an office products retailer, most recently as Vice President, Finance. Mr. Hines spent 12 years in public accounting, the last eight years with the accounting firm Deloitte & Touche LLP. Mr. Hines is also a director of GNC Holdings, Inc., where he serves as non-executive Chairman, and Dunkin’ Brands Group, Inc. Mr. Hines’ experience as a financial executive and certified public accountant provides him with expertise in the retail industry including accounting, controls, financial reporting, tax, finance, risk management and financial management.

Amy B. Lane, 62

Director since 2005

Ms. Lane was a Managing Director and Group Leader of the Global Retailing Investment Banking Group at Merrill Lynch & Co., Inc., from 1997 until her retirement in 2002. Ms. Lane previously served as a Managing Director at Salomon Brothers, Inc., where she founded and led the retail industry investment banking unit. Ms. Lane is also a director of GNC Holdings, Inc., NextEra Energy, Inc. and a member of the board of trustees of Urban Edge Properties. Ms. Lane’s experience as the leader of two investment banking practices covering the global retailing industry has given her substantial experience with financial services, capital markets, finance and accounting, capital structure, acquisitions and divestitures in that industry as well as management, leadership and strategy.

Carol Meyrowitz, 61

Director since 2006

Ms. Meyrowitz has been Chief Executive Officer, other executive officers, and senior Associates;

2018 Proxy Statement 9

1983 to 2001, she held various senior management and merchandising positions with Marmaxx and with Chadwick’s of Boston and Hit or Miss, former divisions of TJX. Ms. Meyrowitz is also a director of Staples, Inc. and was a director of Amscan Holdings, Inc. from 2005 to 2012. Asthe Chief Executive Officer, including awards of stock options, bonuses, and other awards and incentives, based on the evaluation by the Corporate Governance Committee of the Company, and throughperformance of the many other positions Ms. Meyrowitz has held with TJX, Ms. Meyrowitz has a deep understanding of TJX and broad experience in all aspects of off-price retail, including innovation, strategy, buying, distribution, marketing, real estate, finance and accounting, and international operations.

John F. O’Brien, 72

Director since 1996

Mr. O’Brien is the retired Chief Executive Officer and Presidentsuch other factors as the ECC deems relevant;

Willow B. Shire, 67

Director since 1995

Ms. Shire was an executive consultant with Orchard Consulting Group from 1994 until January 2015, specializing in leadership development and strategic problem solving. Previously, she was Chairpersonsuccession plan for the Computer Systems Public Policy Project within the National Academy of Science. She also held various positions at Digital Equipment Corporation, a computer hardware manufacturer, for 18 years, including Vice President and Officer, Health Industries Business Unit. Through her consulting experience and prior business experience, Ms. Shire brings expertise in leadership development, talent assessment, change management, human resources and development practices, cultural assessment and strategic problem solving.

William H. Swanson, 66

Director since February 2015

Mr. Swanson was the Chief Executive Officer and other executive officers.

Pursuant to its charter, the ECC may delegate its authority to a subcommittee or to such other person that the ECC determines is appropriate and is permitted by applicable law, regulations, and listing standards.

The ECC also reviews our compensation policies and practices for our Associates to determine whether they give rise to risks that are reasonably likely to have a material adverse effect on the company. See Compensation Program Risk Assessment, below.

Please see the ECC charter, available on our website, tjx.com, for further details.

FINANCE COMMITTEE

Ms. Lane, Chairman; Mr. Abdalla; Mr. Bennett; Mr. Hines

The Finance Committee is responsible for reviewing and making recommendations to the Board relating to our financial activities and condition. The Finance Committee’s responsibilities include, among other things:

Please see the Finance Committee charter, available on our website, tjx.com, for further details.

EXECUTIVE COMMITTEE

Ms. Meyrowitz, Chairman; Ms. Lane; Mr. O’Brien

The Executive Committee meets at such times as it determines to be appropriate and civil markets throughouthas the world, from July 2003 until March 2014 and served as Chairmanauthority to act for the Board on specified matters during the intervals between meetings of the boardBoard.

10 The TJX Companies, Inc.

COMPENSATION PROGRAM RISK ASSESSMENT

As part of Raytheonour regular enterprise risk assessment process overseen by the Board and described above, we review the risks associated with our compensation plans and arrangements. In fiscal 2018, the ECC reviewed TJX’s Associate compensation policies and practices and determined that they do not give rise to risks that are reasonably likely to have a material adverse effect on TJX. The ECC’s assessment considered what risks could be created or encouraged by our executive and broad-based compensation plans and arrangements worldwide; how those potential risks are monitored, mitigated, and managed; and whether those potential risks are reasonably likely to have a material adverse effect on TJX.

The assessment was led by our Chief Risk and Compliance Officer, whose responsibilities include leadership of our enterprise risk management process, and included consultation with and input from, January 2004 until his retirement in September 2014. Mr. Swanson had a careeramong others, executive officers, senior human resources and financial executives, the ECC’s independent compensation consultant, and internal and external legal counsel. The assessment considered, among other things, factors intended to mitigate risk at TJX, including:

• Board and committee oversight; • the ECC’s use of an independent compensation consultant; • compensation mix, caps on payouts, and emphasis on objective performance-based pay; | • market checks; • Associate communications and training; and • company policies, internal controls, and risk management initiatives. |

The assessment also considered the balance of more than 42 years with Raytheon, during which he held a wide range of leadership positions including serving as President of Raytheon from July 2002 to May 2004, Executive Vice President of Raytheonpotential risks and President of its Electronic Systems division from January 2000 to July 2002, and Executive Vice President of Raytheon and Chairman and Chief Executive Officer of Raytheon Systems Company from January 1998 to January 2000. Mr. Swanson is also a director of NextEra Energy, Inc. Mr. Swanson’s qualifications include expertise in strategic planning, global business operations and extensive leadership experience from serving as chief executive of a Fortune 200 company.

Integrity has been a core tenet of TJX since our inception. We seek to perform with the highest standards of ethical conduct and in compliance with all laws and regulations that relaterewards related to our businesses.compensation programs and the role of those programs in implementing our corporate strategy.

CODES OF CONDUCT AND ETHICS AND OTHER POLICIES

Global Code of Conduct for Associates. We have Corporate Governance Principles, a Global Code of Conduct for our Associates that sets out our expectations that Associates conduct business with honesty and integrity and treat others with dignity and respect. Our Global Code of Conduct prohibits harassment, discrimination, and retaliation and addresses professional conduct, including employment policies, ethical business dealings, conflicts of interest, confidentiality, intellectual property rights, and the protection of confidential information, as well as adherence to laws and regulations applicable to the conduct of our business. We have a Code of Conduct helpline to allow Associates to voice their concerns. We also have procedures for Associates to report complaints regarding accounting and auditing matters, which are available on our website, tjx.com.

Code of Ethics for TJX Executiveswritten charters for each and Director Code of our Board committeesBusiness Conduct and Ethics. As noted above, we have a Director Code of Business Conduct and Ethics. The current versionsEthics that is designed to promote honest and ethical conduct; compliance with applicable laws, rules, and regulations; and the avoidance of these documentsconflicts of interest for our Board members. We also have a Code of Ethics for TJX Executives governing our Executive Chairman, Chief Executive Officer and President, Chief Financial Officer, and other itemssenior operating, financial, and legal executives. The Code of Ethics for TJX Executives is designed to ensure integrity in our financial reports and public disclosures. We intend to disclose any future amendments to, or waivers from, the Code of Ethics for TJX Executives and the Director Code of Business Conduct and Ethics, as required, within four business days of the waiver or amendment through a posting on our website or by filing a Current Report on Form8-K with the Securities and Exchange Commission, or SEC.

ONLINE AVAILABILITY OF INFORMATION

Our Corporate Governance Principles, Global Code of Conduct, Code of Ethics for TJX Executives, Director Code of Business Conduct and Ethics, and charters for our Audit, Corporate Governance, Executive, Executive Compensation, and Finance Committees are available on our website, tjx.com, in the Investors section under Governance: Governance Documents. Information appearing on tjx.com is not a part of, and is not incorporated by reference in, this proxy statement.

2018 Proxy Statement 11

For more than 40 years, TJX has been focused on delivering great value to our customers through the combination of brand, fashion, price, and quality. At the same time, we are committed to our corporate responsibility mission of bringing value to our many important stakeholders—our Associates, customers, communities, vendors, and shareholders.

With our long-held principles of respect, honesty, and integrity, central to our efforts, our Corporate Responsibility program has evolved over time and has reflected our ‘smart for business, good for the world’ thinking. We categorize our global corporate responsibility efforts under four strategic pillars:

We remain focused on continuously enhancing our programs and making a positive, sustainable impact on the world in which we live and conduct our business. To learn more about our evolving efforts, please visit the Responsibility section of our website at tjx.com/responsibility.

We are interested in hearing from our shareholders and communicate regularly with shareholders throughout the year. Security holders and other interested parties may communicate directly with our Board, thenon-management directors or the independent directors as a group, the Lead Director, or any other specified individual director or directors.

To contact us, address your correspondence to the individual or group you would like to reach and send it to us, c/o Office of the Secretary/Legal Department:

The TJX Companies, Inc.

770 Cochituate Road

Framingham, Massachusetts 01701

The Secretary will forward these communications to the relevant group or individual. Shareholders and others can communicate complaints regarding accounting, internal accounting controls, or auditing matters by writing to the

12 The TJX Companies, Inc.

Audit Committee, c/o Corporate Internal Audit Director, The TJX Companies, Inc., 770 Cochituate Road, Framingham, Massachusetts 01701.

TRANSACTIONS WITH RELATED PERSONS

Under its charter, the Corporate Governance Committee is responsible for reviewing and approving or ratifying any transaction in which, in addition to TJX, any of our directors, director nominees, executive officers (or their immediate family members), or any greater than 5% shareholders (or their immediate family members) is a participant and has a direct or indirect material interest, as provided under SEC rules. In the course of reviewing potential related person transactions, the Corporate Governance Committee considers the nature of the related person’s interest in the transaction; the presence of standard prices, rates, or charges or terms otherwise consistent with arms-length dealings with unrelated third parties; the materiality of the transaction to each party; the reasons for TJX entering into the transaction with the related person; the potential effect of the transaction on the status of a director as an independent, outside, or disinterested director or committee member; and any other factors the Corporate Governance Committee may deem relevant. Our General Counsel’s office is primarily responsible for the implementation of processes and procedures for screening potential transactions and providing information to the Corporate Governance Committee. During fiscal 2018, asister-in-law of Mr. Sherr and a daughter of Ms. Meyrowitz were employed by TJX. They received compensation from us for fiscal 2018 and the beginning of fiscal 2019 totaling approximately $281,720 and $133,920, respectively, consistent with other Associates at their levels and responsibilities. They also participated in company benefit plans generally available to similarly situated Associates. As described below in Beneficial Ownership, The Vanguard Group, Inc. reported that it was the beneficial owner of more than 5% of TJX’s outstanding common stock. TJX expects to pay The Vanguard Group, Inc. and its affiliates approximately $1,885,420 for services primarily provided during fiscal 2018 and the first quarter of fiscal 2019 in connection with TJX’s retirement savings plans (including recordkeeping, trustee, and related services). Our Corporate Governance Committee discussed and approved or ratified these transactions, consistent with our review process described above.